UPDATED on Dec. 13, 2018. What are the best Medicare Supplement Plans 2019? In this post, we provide an overview of how to Compare Medigap Plans (also known as Medicare Supplement plans) and give plans’ recommendations.

Original Medicare does not fully cover the allowable Medicare expenses. Only Medicare Supplement plans do cover all Original Medicare gaps (or most of them depending on the nature of the plan): deductibles, copayments/ coinsurances, and excess charges. They are sold by private insurance companies licensed in your state. Here is the list of the major benefits of Medicare Supplement Plans:

- There is no network for Medicare Supplement. You may visit any doctor or hospital, and as long as the doctor/hospital is accepting Medicare, they MUST accept a Medigap plan as the secondary coverage.

- All Medicare Supplement plans are guaranteed renewable, i.e., the insurance company cannot cancel your policy as long as you pay the premium.

- Medicare Supplement benefits are paid by Medigap vendors after Medicare has paid its share of the bill.

- Medigap provides extra benefits that are not a part of Original Medicare, such as foreign travel emergency. Several companies offer additional benefits such as pharmacy savings, vision discount, access to fitness facilities, nurse health line, etc.

Article Contents

Medicare Supplement Standardized Plans

Frequently Asked Questions (FAQ)

Best Medicare Supplement Plans 2019: Standardized Plans

To learn how to compare Medigap plans, it is essential first to review the concept of Standardized Medicare Supplement Plans. There are 10 Standardized Medigap Plans. Each plan has a designated letter (Plan A, Plan B, etc.) and a specific set of primary and extra benefits.

All Medigap plans are standardized, i.e., they have common standards in:

- Medigap Benefits: Any plan from one insurance company has the same benefits as the same plan from another company

- Claim Processing: All insurance companies process claims electronically. It is done through the very efficient Medicare crossover system.

- Claims Decisions: Medicare makes claim decisions, not the Medigap insurance company

Here are three categories of Medicare Supplement plans:

- Comprehensive plans that cover all or most gaps in Original Medicare. Examples are Medicare Supplement Plan F, Medicare Supplement Plan G, Medicare Supplement Plan C, and Medicare Supplement Plan D.

- Copayment-based plans that use copayments for doctors and emergency visits. For example, Medicare Supplement Plan N.

- High-Deductible plans where you need to pay a deductible first before the plan starts its coverage. For example, High-deductible Medicare Supplement Plan F.

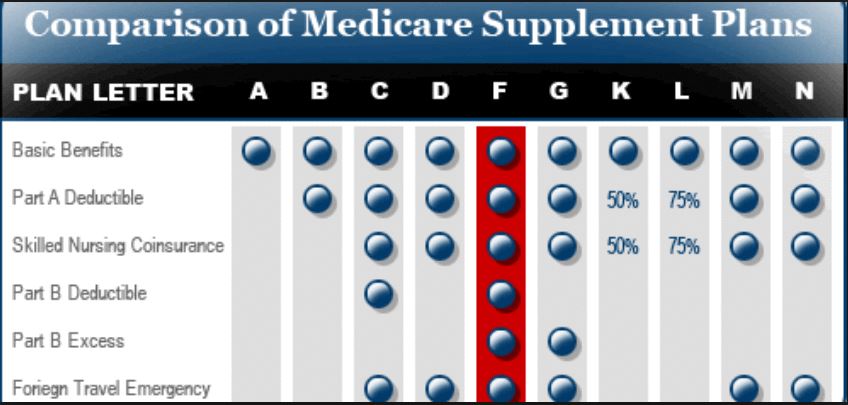

The table below presents 2019 Standardized Medigap Plans and is critical in learning how to compare Medigap plans. Notice, that a specific benefit for a particular plan is covered by a certain percentage, if the cell is not empty (X stands for 100% coverage)

|

Medicare Supplement Plans |

|||||||||||

| Medicare Supplement Benefits |

A |

B |

C |

D |

F* |

G |

K |

L |

M |

N |

|

| Medicare Part A Coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

|

| Medicare Part B Coinsurance or Copayment |

X |

X |

X |

X |

X |

X |

50% |

75% |

X |

X** |

|

| Blood (First 3 Pints) |

X |

X |

X |

X |

X |

X |

50% |

75% |

X |

X |

|

| Part A Hospice Care Coinsurance or Copayment |

X |

X |

X |

X |

X |

X |

50% |

75% |

X |

X |

|

| Skilled Nursing Facility Care Coinsurance |

X |

X |

X |

X |

50% |

75% |

X |

X |

|||

| Medicare Part A Deductible |

X |

X |

X |

X |

X |

50% |

75% |

50% |

X |

||

| Medicare Part B Deductible |

X |

X |

|||||||||

| Medicare Part B Excess Charges |

X |

X |

|||||||||

| Foreign Travel Emergency (Up to Plan Limits) |

80% |

80% |

80% |

80% |

80% |

80% |

|||||

| Out-of-Pocket Limit | None | None | None | None | None | None | $5,240 | $2,620 | None | None | |

Table 1: Standardized Medicare Supplement Plans

* Medicare Supplement Plan F also offers a high-deductible plan.

** Medicare Supplement Plan N pays 100% of the Part B coinsurance except for up to $20 copayment for doctor’s office visits and up to $50 for emergency room visits.

Return to Top

Best Medicare Supplement Plans 2019: Recommendations

This Section provides recommendations on the best Medicare Supplement plans. For simplicity, we limit ourselves only with the most popular plans.

Medigap Plans

Medicare Supplement – Plan A

Medicare Supplement Plan A is often referred to as the Basic Supplemental Insurance Plan. All insurance companies selling Medigap policies must offer Plan A.

Medicare Supplement Plan A offers only the basic coverage; therefore, its price is more affordable compared to any other plan. Enroll in this plan if you prefer to have only critical benefits, and are prepared to assume the remaining risk. For some, this plan is the right choice.

Medicare Supplement Plan F

Medicare Supplement Plan F is the most comprehensive Medicare Supplement plan available. It covers all Medicare ‘gaps,’ and is the only plan that includes both Medicare Part B deductible and Medicare Part B excess charges. It was until recently the most popular plan. Most Medicare Supplement insurance companies offer Medigap Plan F.

Because the Medicare Supplement Plan F covers all Medigap “gaps”, you won’t have any out-of-pocket expenses when you visit a doctor or hospital. This plan, however, is the most expensive. Select Plan F if the security and predictability of not having to pay anything out-of-pocket (other than premium) are the most important for you.

In addition to Plan F, some vendors offer High-Deductible Medicare Supplement Plan F. It is the same as Medigap Plan F, except that you have to pay the deductible amount ($2,300 in 2019) before your Medigap Plan pays anything. Naturally, the premium for the high-deductible plan F is substantially lower than the premium for the standard plan F.

The plans offering coverage of Medicare Part B deductible (Medigap Plan C and Medigap Plan F) will no longer be available starting year 2020. However, the current Medicare Supplement policyholders and new enrollees up to 2020 would be protected.

Medicare Supplement Plan G

Medicare Supplement Plan G, also known as Medigap Plan G, covers all Medicare ‘gaps’ except for Medicare Part B Deductible. The Plan G premiums vary quite extensively between companies. Most Medicare Supplement insurance companies offer Medigap Plan G.

Medigap Plan G is the same with the Medigap Plan F, excluding the fact that it does not cover Medicare Part B deductible. As long as the difference between plan F and plan G premiums exceeds the Part B deductible, it makes sense to go with Plan G. Use Medigap Plan G (if available) when savings in premium justify removing Medicare Part B Deductible from the benefits.

As of 2020, Medicare Supplement plans will no longer sell NEW Medigap Plan F. It will make Medicare Supplement Plan G even more attractive choice.

Medicare Supplement Plan N

Medicare Supplement Plan N, also known as Medigap Plan N, was introduced in June of 2010. In order to lower monthly premium costs, Plan N uses copays which include: up to $20 for a doctor’s visit, and $50 for emergency visits. The result is an affordable and very popular plan with a monthly premium 30%-35% lower than the all-covering the Medigap Plan F and 12%-15% lower than Medigap Plan G. Most Medicare Supplement insurance companies offer Plan N.

Medicare Supplement Plan N is the right choice for anyone in good health which only visits a doctor occasionally and doesn’t want to be over insured.

For those who are now enrolled in Medicare Advantage and would like to return to Original Medicare it is important to note that because Medigap plans don’t have network restrictions and much lower out-of-pocket expenses, Medigap Plan N provides a cost-effective alternative to Medicare Advantage.

Ultimately, for people who are healthy or on a fixed income, Medicare Supplement Plan N premium savings may offset benefits presented in more expensive plans, such as Medigap Plan F. Good health is important: savings in premium payments using Medigap Plan N will not compensate you for the money spent on copayments if you see a doctor on a frequent basis (let’s say twice per month).

- Is there any network for Medicare Supplement plans?

- NO, as long as your doctor accepts Medicare, he/she should also take your Medigap plan. SELECT plans are the only exception (see Question 6)

- Are Medicare Supplement benefits depend on Medigap vendor?

- The benefits of Medigap plans are NOT dependent on vendors. All Medicare Supplement plans are standardized, i.e., any plan bought from one company is identical to the same plan purchased from any other company. The premium, however, may vary from vendor to vendor.

- What are the most popular Medicare Supplement Plans?

- Until recently the two most popular plans were Plan F and Plan N. Recently, Medigap Plan G has joined the group. Because of the new regulation (see Question 7), Plan G may replace Plan F as the most popular plan.

- When is Medigap Plan G preferred to Plan F?

- Medigap Plan G is the same as the Medigap Plan F, but it does not cover Medicare Part B deductible. Use Medigap Plan G when savings in premium justify removing Medicare Part B Deductible from the benefits.

- When is Medigap Plan N the right choice?

- Plan N includes copays for doctor’s visit and emergency visits. It results in a reduced premium. Medicare Supplement Plan N is the right choice for anyone in good health who doesn’t want to be over insured.

- What are Medicare Supplement SELECT plans?

- In some states, insurance companies may also sell a Medicare Supplement Select policy. It is a type of Medigap policy that limits your access to providers within a network. As a result, your premium will be lower.

- What are expected Medicare Supplement Changes in 2020?

- Medigap plans that include coverage of Part B deductible (Plan F, Plan C, and Plan F High-Deductible) will no longer be available starting year 2020. However, the current Medigap policyholders and new enrollees up to 2020 would be protected.

- What is Medigap coverage of Foreign Emergency?

- Medicare Supplement plans C, D, F, G, M, and N pay 80% of the billed charges for medically necessary emergency care outside the U.S. after you meet a $250 deductible per year.

US Government Sources

- How to Compare Medigap Policies?

- Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare

Please give us your feedback!

What do you think about Best Medicare Supplement Plans 2019? Write your comments.

Contact Us

Liberty Medicare is here to help you how to compare Medigap plans, and how to select and enroll in the best and most suitable Medicare Supplement Plan for you.

All of our services are offered to you at no cost. We’ll help you:

- Find all available to you plans and compare their benefits

- Determine your eligibility (particularly if medical underwriting is required)

- Find the least expensive Medigap plan and enroll into it

Learn more about all benefits of working with Liberty Medicare.

If you are looking for Medicare Supplement coverage, please contact Liberty Medicare, or give us a call at 877-657-7477.

Comments are closed.