Medicare Supplement Plan F (Medigap Plan F) – 2024

UPDATED, Oct. 27, 2023. Medicare Supplement Plan F, also known as Medigap Plan F, is the most comprehensive Medicare Supplement plan available. It covers all Medicare ‘gaps’, and is the only plan that includes both Medicare Part B deductible and Medicare Part B excess charges. It is also the most popular plan.

Get familiar with Medicare Supplement – Liberty Medicare Library

Like all Medigap plans, Medicare Supplement Plan F is standardized. Its benefits are the same and do not depend on the company offering the plan. However, premiums may be very different from company to company.

Most Medicare Supplement insurance companies offer Medigap Plan F.

Article Contents

Plan F High-Deductible Benefits

When is Medigap Plan F the right choice?

Is Plan F available?

Starting in 2020, Medicare Supplement vendors cannot sell NEW Medicare Supplement Plans F and F High-Deductible. Congress has decided that after January 1, 2020, the new Medigap plans are no longer be allowed to cover the Part B deductible, and it affects Plan F. Anyone enrolled in a Medicare Supplement Plan F (or High Deductible F) as of 12/31/2019 can continue to use the plan (including coverage of the Part B deductible) as long as they want.

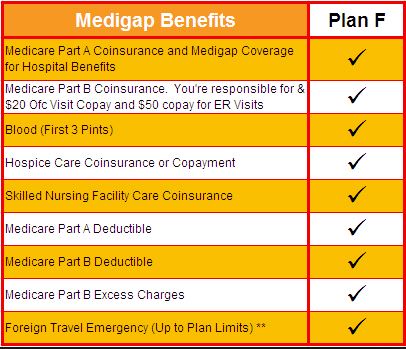

Medicare Supplement Plan F Benefits

- Medicare Part A coinsurance and hospital costs up to an additional 365 days after Original Medicare benefits are consumed.

- Medicare Part B coinsurance or copayment.

- Blood (first 3 Pints).

- Part A Hospice Care coinsurance or copayment.

- Skilled Nursing Facility Care coinsurance.

- Medicare Part A Deductible ($1,632 in 2024).

- Medicare Part B Deductible ($240 in 2024).

- Medicare Part B Excess Charges.

- Foreign Travel Emergency (Plan Limit is applied).

Medicare Supplement High-Deductible Plan F Benefits

High-Deductible Medicare Supplement Plan F is the same as Medigap Plan F, apart from having to pay the deductible amount ($2,800 in 2024) before your Medigap Plan pays anything. Naturally, the premium for the high-deductible plan F is substantially lower than the premium for the standard plan F.

Frequently Asked Questions

- How is Medigap Plan F different from Plan G?

- Medigap Plan F is the same as the Medigap Plan G, but it DOES cover Medicare Part B deductible ($240 is 2024)

- Does any doctor accept the Medigap Plan F?

- YES, as long as your doctor accepts Medicare.

- Are Plan F benefits depend on Medigap vendor?

- The benefits of Medigap plans are NOT dependent on vendors. All Medicare Supplement plans are standardized, i.e., any plan bought from one company is identical to the same plan purchased from any other company. Plan F premium, however, may vary from vendor to vendor.

- Does Medicare Supplement Plan F cover prescription drug plan?

- NO, it does not. You need to buy Medicare Part D (Prescription Drug Plan) separately.

- What is Plan F coverage of Foreign Emergency?

- Plan F pays 80% of the billed charges for medically necessary emergency care outside the U.S. after you meet a $250 deductible per year.

When is Medicare Supplement Plan F the right choice?

Because Plan F covers all Medigap “gaps,” you won’t have any out-of-pocket expenses when you visit a doctor or hospital. This plan, however, is the most expensive. Select Plan F if the security and predictability of not having to pay anything out-of-pocket (other than premium) are the most important for you.

Plan F vs. G

Medigap Plan G is identical to the Medicare Supplement Plan F, except it does not include the Medicare Part B deductible. Use Plan F (if available in your area) if the Medicare Part B deductible exceeds the difference in premiums between plans F and G.

Plan F vs. C

Medigap Plan C is identical to the Medicare Supplement Plan F, except Plan C does not include the Medicare Part B excess charges. Use Plan F (if available in your area) if the advantage of covering Part B excess charges exceeds the difference in premiums between plans F and C.

US Government Reading

- How to Compare Medigap Policies?

- Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare

Let Liberty Medicare Help you Choose

With 10 Standardized Medicare Supplement plans available, it may be not an easy task to select the right plan. Not all Medigap providers carry all plans, and the difference in premiums for the same type of plan among different vendors may be rather significant.

Take advantage of Liberty Medicare and find the Medicare Supplement plan that is best for your needs and budget. All our services are absolutely free to you! Learn more about all the benefits of working with Liberty Medicare.

We represent many well-known Medicare Supplement providers and help people save money on Medicare in the following states:

Get a free Medicare Supplement Insurance Quote, or feel free to call us at 877-657-7477. Our specialists are ready to answer your questions.