Medicare Savings Programs (MSP): Help with Medicare Expenses

UPDATED Nov. 17, 2025. Medicare Savings Programs (MSP) provide assistance in paying your Medicare premiums and, in some cases, Part A and Part B deductibles, coinsurance and copayments. These programs are administrated by Medicaid and they have asset and income limits.

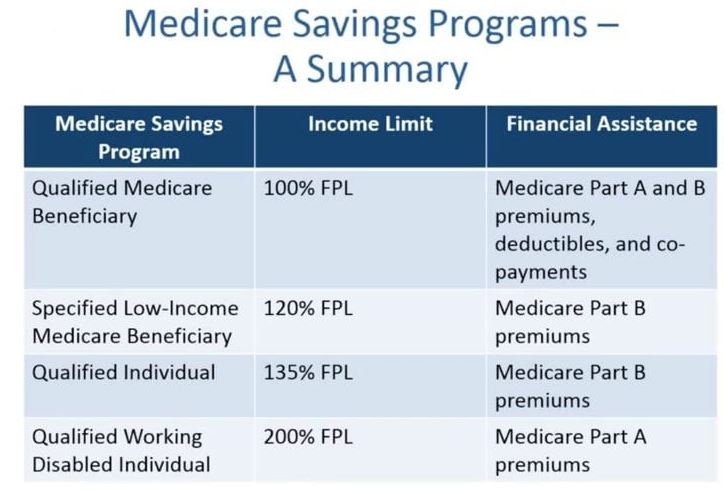

There are four types of State Medicare Savings Programs providing Help with Medicare Expenses:

- Qualified Medicare Beneficiary (QMB)

- Specified Low-Income Medicare Beneficiary (SLMB)

- Qualified Individual (QI)

- Qualified Disabled and Working Individuals (QDWI)

Types of Medicare Savings Programs

Four types of Medicare Savings Programs are described below (2025):

Qualified Medicare Beneficiary (QMB)

- Requirements: Have or be eligible for Medicare Part A; Meet the income and resource guidelines (see below)

- Income: Single/Married monthly income should be below $1,325 for an individual and $1,783 for a couple. The monthly income corresponds to 100% of the Federal Poverty Level (FPL).

- Resource Limit: Single/Married resources should be less than $9,660 / $14,470.

- Program Helps Pay: Part A premium; Part B premium; Deductibles, coinsurance, and copayments; Extra Help (LIS)

Specified Low-Income Medicare Beneficiary (SLMB)

- Requirements: Have or be eligible for Medicare Part A; Meet the income and resource guidelines (see below)

- Income: Single/Married monthly income should be below $1,585 for an individual and $2,135 for a couple. The monthly income limits range from 100% to 120% of the Federal Poverty Level (FPL) plus $20.

- Resource Limit: Single/Married resources should be less than $9,660 / $14,470.

- Program Helps Pay: Part B premium only; Extra Help (LIS)

Qualified Individual (QI)

- Requirements: Have or be eligible for Medicare Part A; Meet the income and resource guidelines (see below)

- Income: Single/Married monthly income should be below $1,781 for an individual and $2,400 for a couple. The monthly income limits range from 120% to 135% of the Federal Poverty Level (FPL) plus $20.

- Resource Limit: Single/Married resources should be less than $9,660 / $14,470.

- Program Helps Pay: Part B premium only; Extra Help (LIS)

Qualified Disabled and Working Individuals (QDWI)

- Requirements: Have or be eligible for Medicare Part A; You must be a disabled individual who has lost Medicare Part A benefits because you returned to work and are not otherwise eligible for Medicaid benefits; meet the income and resource guidelines (see below)

- Income: Single/Married monthly income should be below $5,302 for an individual and $t,135 for a couple.

- Resource Limit: Single/Married resources should be less than $4,000 / $6,000.

- Program Helps Pay: Part A premium only (but not any coinsurance or deductible) for working disabled people

Am I eligible for Help with Medicare Costs?

The only way to know for sure whether you are eligible for one of the Medicare Savings Programs is actually to apply. If you receive income from working, you may qualify even if your income is higher than the limits above. Many states figure your income and resources differently, so you may be eligible even if you exceed the published limits above. You may locate their number by calling 1-800-MEDICARE (1-800-633-4227).

US Government Sources

How Can Liberty Medicare Help?

Liberty Medicare is a leading insurance agency that specializes in Medicare insurance in the following states: Delaware, Florida, Maryland, New Jersey, New York, Ohio, Pennsylvania, and Virginia. All our services are provided to you at no cost. An essential part of our job is working with low-income senior citizens and providing guidance on the available Medicare Savings Programs that can help with Medicare Expenses.

Please contact us if you require assistance with applying for Medicare Savings Programs.

Get our Medicare Quotes, or give us a call at 877-657-7477, and you will be connected to a licensed agent/broker.