3 Reasons to Choose Medicare Supplement Plan G (Medigap Plan G) – 2025

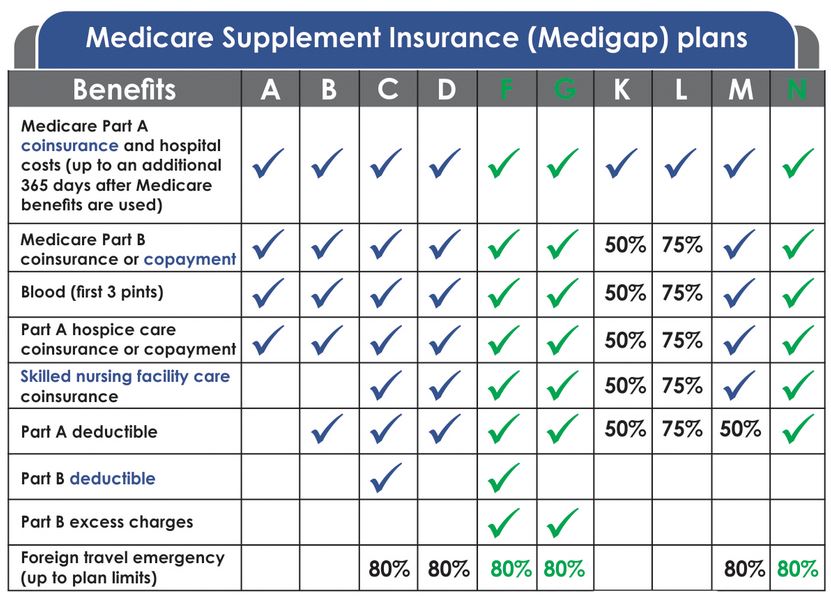

UPDATED Nov. 24, 2024. Medicare Supplement Plan G, also known as Medigap Plan G, covers all Medicare ‘gaps’ except for Medicare Part B Deductible. Just like all Medigap plans, Plan G is standardized.

Get familiar with Medicare Supplement – Liberty Medicare Library

Most Medicare Supplement insurance companies are offering Medigap Plan G. Its benefits the same for any company offering the plan. However, you will notice that Plan G premiums vary quite extensively between companies.

Here we’ll discuss the main reasons to choose Medigap Plan G in 2025.

Article Contents

Plan G High-Deductible Benefits

Three Reasons to choose Medigap Plan G in 2025

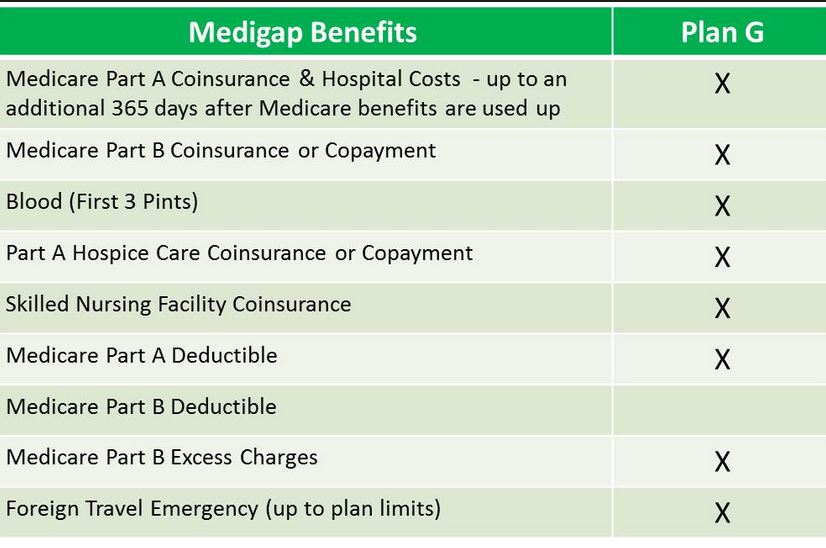

Medicare Supplement Plan G benefits include:

- Hospital Costs: Medicare Part A coinsurance plus 365 additional days after Medicare benefits are used.

- Medical Expenses: Medicare Part B coinsurance (20% of Medicare outpatient expenses) or copayment.

- Blood (the first 3 Pints per each calendar year).

- Part A Hospice Care coinsurance or copayment.

- Skilled Nursing Part A coinsurance (Up to $209.50 a day for days 21 through 100 in 2025)

- Medicare Part A Deductible: $1,676 per benefit period in 2025.

- Medicare Part B Excess Charges.

- Foreign Travel Emergency – Medically necessary emergency care services during the first 60 days of each trip outside the USA.

You are responsible for the first $250 each calendar year.

Medicare Supplement Plan G benefits do NOT include:

- Medicare Part B Deductible: $257 per year in 2025.

Medicare Supplement High-Deductible Plan G Benefits

High-Deductible Medicare Supplement Plan G is the same as Medigap Plan G, apart from having to pay the deductible amount ($2,870 in 2025) before your Medigap Plan pays anything. Naturally, the premium for the high-deductible plan G is substantially lower than the premium for the standard plan G.

Frequently Asked Questions

- How is Medigap Plan G different from Plan F?

- Medigap Plan G is the same as the Medigap Plan F, but it does not cover Medicare Part B deductible ($257 is 2025)

- Does any doctor accept the Medigap Plan G?

- YES, as long as your doctor accepts Medicare.

- Are Plan G benefits depend on Medigap vendor?

- The benefits of Medigap plans are NOT dependent on vendors. All Medicare Supplement plans are standardized, i.e., any plan bought from one company is identical to the same plan purchased from any other company. Plan G premium, however, may vary from vendor to vendor.

- Does Plan G cover prescription drug plan?

- NO, it does not. You need to buy Medicare Part D (Prescription Drug Plan) separately.

- What are Medicare Supplement Changes in 2020?

- Medigap plans that include coverage of Part B deductible (Plan F, Plan C, and Plan F High-Deductible) are no longer available starting year 2020. However, the current Medigap policyholders and new enrollees up to 2020 are protected.

- What is Medigap Plan G coverage of Foreign Emergency?

- Plan G pay 80% of the billed charges for medically necessary emergency care outside the U.S. after you meet a $250 deductible per year.

3 Reasons to Choose Medicare Supplement Plan G in 2025

- Medicare Supplement Plan G is the same with Medicare Supplement Plan F, excluding the fact that it does not cover Medicare Part B deductible. As long as the difference between plan F and plan G premiums exceeds the Part B deductible, it makes sense to go with Plan G.

- Historically, annual premium increases of Medicare Supplement Plan F are higher than for Plan G.

- As of 2020, Medicare Supplement vendors are no longer sell NEW Medigap Plan F. It makes Medigap Plan G even more attractive choice.

Use Medigap Plan G (if available) when savings in premium justify removing Medicare Part B Deductible from the benefits.

Read more in Medicare Supplement Plan G vs Plan F.

US Government Reading

- How to Compare Medigap Policies?

- Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare

Let Liberty Medicare Help you Choose

Considering the 10 Standardized Medicare Supplement plans, it may be not an easy task to select the right plan for you. Not all Medigap providers carry all of these plans, and the difference in premiums for the same type of plan among different vendors tends to be rather substantial.

With the help of Liberty Medicare, find the Medicare Supplement plan that is best for your needs and budget. All our services are absolutely free to you. Learn more about all the benefits of working with Liberty Medicare.

We represent many well-known Medicare Supplement providers and help people save money on Medicare in the following states:

Get a free Medicare Supplement Insurance Quote, or feel free to call us at 877-657-7477. Our specialists are ready to answer your questions.