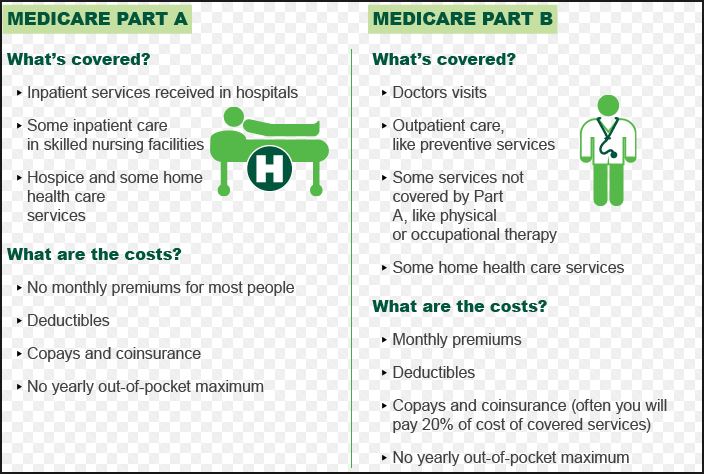

Medicare Part A – Hospital Insurance

UPDATED Nov. 16, 2025. Medicare Part A is the Hospital Insurance portion of Original Medicare. Original Medicare allows you to use any doctor, specialist, or hospital that accepts Medicare. You do not need a referral. You are paying a separate amount for each service, also called a fee-for-service.

Who is eligible for Medicare Part A?

What are Part’s A (Hospital Insurance) benefits?

- Inpatient hospital care such as critical access hospitals, inpatient rehabilitation facilities, and long-term care hospitals.

- Skilled nursing facility care

- Inpatient care in a skilled nursing facility, however, this doesn’t include custodial or long-term care.

- Hospice care services

- Home health care services

What is the Medicare Part A premium (2026)?

Most people age 65 or older don’t have to pay a monthly payment (referred to as a premium) for Part A because they, or their spouse, paid Medicare taxes while they were working 40 or more quarters of Medicare-covered employment.

People under age 65 who are disabled and have received disability benefits under Social Security or the Railroad Retirement Board for 24 months, as well as dialysis or kidney transplant patients, do not have to pay a Part A monthly premium.

Individuals having 30-39 quarters of Medicare-covered employment will pay $311.00, while individuals having less than 30 quarters of Medicare-covered employment will pay $565.00 per month.

How much is deductible (2026)?

- $1,736.00 (per benefit period)

- First 3 pints of blood needed in a calendar year

How much is coinsurance (2026)?

- $0 per day for days 1-60 of each benefit period

- $434.00 per day for days 61-90 of each benefit period

- $868.00 per each of Lifetime Reserved Days (up to 60 days over a lifetime) after day 90 of each benefit period

How much is skilled nursing insurance (2026)?

- $0 per day for days 1-20 of each benefit period

- $217 per day for days 21-100 of each benefit period

- All costs for each day after day 100

When and how may I enroll in Part A?

When and How to Enroll in Medicare

US Government Sources

Let Liberty Medicare Help You

Use Medicare Supplement (Medigap) to protect yourself against charges that Part A does not cover. It includes multiple ‘gaps’ (deductibles, coinsurances), which can add up very quickly.

For free assistance in choosing the Medicare Plan that is best for you, contact our Agency. Alternatively, give us a call at 877-657-7477, and you will be connected to a licensed agent/broker.