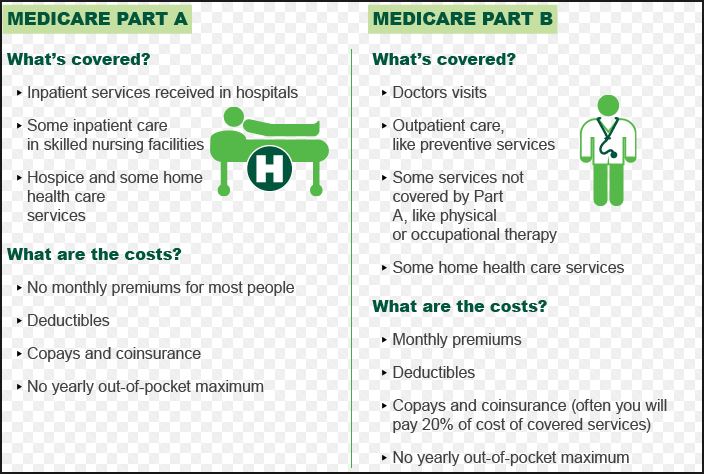

Medicare Part B – Medical Insurance

UPDATED Nov. 16, 2025. Medicare Part B is the Medical Insurance portion of Original Medicare. It is optional. Original Medicare allows you to use any doctor, specialist, or hospital that accepts Medicare. You do not need a referral. You are paying a separate amount for each service, also called a fee-for-service. Part B only pays for services determined to be reasonable and necessary in the diagnosis and treatment of a specific illness or injury.

Who is eligible for Medicare Part B?

What are the Medicare Part B (Medical Insurance) benefits?

Medically necessary services: Doctors’ services (including most inpatient doctor services), outpatient medical and surgical services and supplies, outpatient hospital services, certain home health services, lab services, durable medical equipment, and other medical services. Medically necessary Services do not include routine physical exams.

Preventive services: Exams, lab tests, or screenings that will help diagnose, manage, or prevent a medical problem.

How much is the Part B premium?

- The standard Part B premium amount for the year 2026 is $202.90.

- People with a higher income ($109,000 or higher for a single person, or $218,000 or higher for joint filers) will pay a higher premium, which is based on their modified adjusted gross income (MAGI).

How much is Part B deductible?

- Part B deductible for the year 2026 is $283.00 per year.

How much is Part B coinsurance?

You pay 20% of the Medicare-approved amount for doctors’ visits after you meet $283.00 deductible. There is no limit on your spending.

Beneficiaries have no cost-sharing for most preventive services.

What are Part B excess charges?

Most doctors accept Medicare assignment and agree to receive Medicare payment as full payment. Some doctors don’t accept assignment (non-participating providers), but they do submit claims to Medicare.

For services rendered by non-participating providers, a physician may charge a maximum of 115% of the Medicare-approved amount. This 15% overcharge is known as Excess Charges, and you are responsible for them. In some states (such as Pennsylvania), you cannot charge more than the Medicare-approved amount. It is known as the Medicare Overcharge Measure law (MOM).

Do you need Medicare Part B?

Decide if you need Medicare Part B

When and how may I enroll in Part B?

When and How to Enroll in Medicare

US Government Sources

Let Liberty Medicare Help You

Use a Medicare Supplement (Medigap) to protect yourself against the charges that Part B does not cover. It includes multiple ‘gaps’ (deductibles, coinsurances) that can add up very quickly.

For free assistance in choosing a Medicare Plan that is best for you, contact our Agency. Alternatively, give us a call at 877-657-7477, and you will be connected to a licensed agent/broker.