How to Compare Medicare Supplement Plans

UPDATED Nov. 17, 2025. To learn how to compare Medicare Supplement plans (also known as Medigap plans), we need to be familiar with the concept of Standardized Plans. All Medigap plans are standardized, i.e., they have common standards in

- Medigap Benefits

- Claim Processing

- Claims Decisions

- Doctor’s Network

Article Contents

Medicare Supplement Standardized Plans

Original Medicare Cost without Medigap

Additional Details: Plan by Plan

Compare Medicare Supplement Plans: Standardized Plans

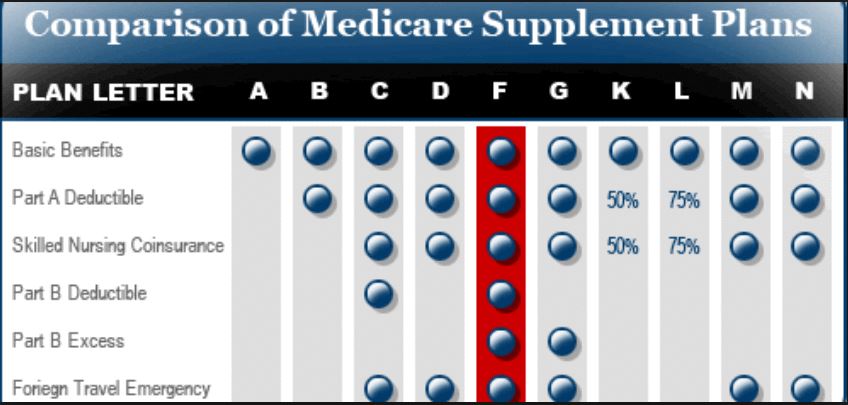

The comparison table below presents Standardized Medicare Supplement Plans – Medigap Plan A, Plan B, Plan C, Plan D, Plan F, Plan G, Plan K, Plan L, Plan M, and Plan N.

Please note:

- If ‘X’ appears in a column, the Medigap plan covers 100% of the described benefit.

- If a column lists a percentage, the plan covers the percentage of the described benefit.

- If a column is blank, the plan does not cover that benefit.

|

Medicare Supplement Plans |

|||||||||||

| Medicare Supplement Benefits |

A |

B |

C* |

D |

F*/** |

G** |

K*** |

L*** |

M |

N**** |

|

| Medicare Part A Coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up |

X |

X |

X |

X |

X |

X |

X |

X |

X |

X |

|

| Medicare Part B Coinsurance or Copayment |

X |

X |

X |

X |

X |

X |

50% |

75% |

X |

X** |

|

| Blood (First 3 Pints) |

X |

X |

X |

X |

X |

X |

50% |

75% |

X |

X |

|

| Part A Hospice Care Coinsurance or Copayment |

X |

X |

X |

X |

X |

X |

50% |

75% |

X |

X |

|

| Skilled Nursing Facility Care Coinsurance |

X |

X |

X |

X |

50% |

75% |

X |

X |

|||

| Medicare Part A Deductible |

X |

X |

X |

X |

X |

50% |

75% |

50% |

X |

||

| Medicare Part B Deductible |

X |

X |

|||||||||

| Medicare Part B Excess Charges |

X |

X |

|||||||||

| Foreign Travel Emergency (Up to Plan Limits) |

80% |

80% |

80% |

80% |

80% |

80% |

|||||

| Out-of-Pocket Limit | None | None | None | None | None | None | $8,000 | $4,000 | None | None | |

Table 1: Standardized Medicare Supplement Plans – 2026

NOTES

* Plans C, F and F High-Deductible are NOT available to people who are newly eligible for Medicare on or after January 1, 2020. Learn more from What are Medicare Supplement Changes in 2020?

** Medicare Supplement Plans F and G also offer a high-deductible plan in some states. With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,950 in 2026 before your policy pays anything.

*** For Plans K and L, after you meet your out-of-pocket yearly limit and your yearly Part B deductible ($283 in 2026), the Medigap plans pays 100% of covered services for the rest of the calendar year.

** Medicare Supplement Plan N pays 100% of the Part B coinsurance, except for up to $20 copayment for doctors’ office visits and up to $50 for emergency room visits that don’t result in an inpatient admission

Return to Top

Original Medicare Cost without Medigap

The next table provides some examples of costs you could pay if you have Original Medicare and DO NOT have a Medigap policy. (See also Part A and Part B).

| Cost | What you pay in 2026 |

| Medicare Part A Coinsurance and all costs after hospital benefits are exhausted | For each benefit period; you pay $434 per day for days 61-90, $868 per day for days 91-150 (while using your 60 lifetime reserve days), and all costs after 150 days. |

| Medicare Part B Coinsurance or Copayment for other than preventive services | You pay all coinsurance, generally 20% of the Medicare-approved amount for most covered services and any copayment after you meet the $283 yearly Part B deductible. |

| Blood | Generally, you pay for the first 3 pints of blood you receive. |

| Hospice Care Coinsurance or Copayment | You may be required to pay up to $5 for each drug a hospice provides when you are getting hospice services in your home and 5% of the Medicare-approved amount for each day of inpatient respite care (up to certain limits). |

| Skilled Nursing Facility Care Coinsurance | For each benefit period, you pay nothing for the first 20 days and up to $217 per day for days 21-100. |

| Medicare Part A Deductible | For each benefit period, you pay $1,736 for the first 60 days of a hospital stay. |

| Medicare Part B Deductible | You pay the $283 yearly deductible. |

| Medicare Part B Excess Charges | For doctors and other providers who don’t accept Medicare assignment, you pay the difference between the Medicare-approved amount and either the provider’s fee, or the “limiting charge” (no more than 15% above the Medicare-approved amount) that applies for doctor’s fees and many other Part B services. |

| Foreign Travel Emergency (Medicare coverage outside the U.S.) | Generally, you pay all costs. |

Table 2: Original Medicare Costs WITHOUT Mediap

Compare Medicare Supplement Plans: Additional Details

Any hospital benefits (Medicare Part A) in Medigap plans A through F are covered at 100%. Medicare Supplement Plan A is the core plan, and Medicare Supplement Plan F is the most comprehensive. Therefore, in general, the premium cost is the lowest for plan A and the highest for plan F.

Medigap Plans

High-Deductible Plans F and G

Plans K and L

Plans M and N

SELECT Plans

Changes from 2020

Foreign Travel

Compare Medicare Supplement Plans: Medicare Supplement High-Deductible Plan F

Medicare Supplement plans F and G also offer high-deductible plans. In those plans, you must pay for Medicare-covered costs up to the deductible amount of $2,950.00 in 2026 before your Medigap plan pays anything.

Return to Plans

Compare Medicare Supplement Plans: Medicare Supplement Plans K and L

In Medicare Supplement plans K and L, after you meet your out-of-pocket yearly limit and your annual Part B deductible ($283 in 2026), the Medigap plan pays 100% of the covered services for the rest of the calendar year. There are out-of-pocket limits ($8,000 for plan K, and $4,000 for plan L) – the maximum amount you would pay for coinsurance and copayments in 2026.

Return to Plans

Compare Medicare Supplement Plans: Medicare Supplement Plans M and N

Medicare Supplement Plan M and Medicare Supplement Plan N provide cost-sharing features and have lower premiums in comparison with standard Medicare Supplement plans such as F and G. These plans (particularly plan N) may be an ideal option for people who are in good health and don’t want to be over-insured. Therefore, they are also well-suited for those who are enrolled in Medicare Advantage and consider returning to Original Medicare.

Neither of these plans pays the annual Part B deductible, as well as Part B excess charges (up to a 15% charge from doctors who do not accept Medicare assignments). Medicare Supplement plan M covers only 50% of the Part A deductible, and the remaining balance (50%) may be a substantial amount. Medicare Supplement plan N pays 100% of the Plan B coinsurance except for up to $20 copayment for office visits and up to $50 for emergency room visits.

‘Lower utilization’ plans, such as M and N (i.e., plans that have relatively healthy enrollees), will have a lower premium increase in the future compared with ‘higher utilization’ Medicare Supplement plans, such as C and F.

Return to Plans

Compare Medicare Supplement Plans: Medicare Supplement SELECT Plans

In some states, insurance companies may also sell a Medigap Select policy. It is a type of Medigap policy that may require you to use certain providers within a network. Therefore, if you buy the Select plan, your premium may be lower.

Return to Plans

Compare Medicare Supplement Plans: Medicare Changes from 2020

Medigap Plan C, Medigap Plan F, and Medigap Plan F High Deductible offer coverage of the Medicare Part B deductible ($283 in 2026). These plans are no longer available as of January 1, 2020. However, the current Medigap policyholders and new enrollees up to 2020 are protected.

Return to Plans

Compare Medicare Supplement Plans: Foreign Travel Emergency

Medicare Supplement plans C, D, F, G, M, and N pay 80% of the billed charges for medically necessary emergency care outside the U.S. after you meet a $250 deductible per year.

Additional limitations include:

- Benefits are applied only during the first 60 days of any trip

- There is a lifetime limit of $50,000 for foreign travel emergency coverage

US Government Sources

- How to Compare Medigap Policies?

- Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare

Let Liberty Medicare Help you to Compare Medicare Supplement Plans

Liberty Medicare is here to help you in the process of comparing, selecting, and enrolling in the best and most suitable Medicare Supplement Plan for you.

All our services are provided to you at no cost. We’ll help you:

- Find all plans available to you and compare their benefits

- Determine your eligibility (particularly if Medical Underwriting is required)

- Find the least expensive Medicare Supplement plan for your needs

- Understand your options when switching plans

Liberty Medicare represents many well-known Medicare Supplement providers in Delaware, Florida, Maryland, New Jersey, New York, Ohio, Pennsylvania, and Virginia. Learn more about all the benefits of working with Liberty Medicare.

If you are looking for a Medicare Supplement Plan, let us help. To receive a quote, please fill out our Medicare Supplement Quote form or give us a call at 877-657-7477.