Medicare Supplement Plans (Medigap Plans) Explained

UPDATED Nov. 16, 2025. Medicare Supplement Plans (Medigap Plans) are plans sold by private insurance companies that are licensed in your state. The prime purpose of Medicare Supplement Insurance (Medicare Medigap) is to fill the gaps in Parts A and B of Original Medicare.

Liberty Medicare Library – How to get peace of mind by using a Medicare Supplement Plan?

Article Contents

What do Medicare Supplements Cover?

Standardized Medicare Supplement Plans

Do I need a Medicare Supplement (Medigap) Policy?

Medicare Supplement Eligibility

Medicare Supplement Insurance in Depth

Common Medicare Medigap Misconceptions

What do Medicare Supplement Plans Cover?

Medicare Supplement Plans (Medigap Plans) provide protection against the future (catastrophic) losses for Original Medicare out-of-pocket expenses, such as:

- Deductibles

- Copayments/ coinsurances

- Excess charges

See Part A and Part B for the description of out-of-pocket costs. Medicare Supplement benefits are paid for by Medicare Supplement insurance after Medicare has paid its share of the bill.

Medicare Supplement benefits do not include:

- Long-Term Care

- Private-duty Nursing

- Outpatient Prescription Drugs

- Vision Services

- Hearing Services

- Dental Services

Because Medicare Supplement does not cover prescription drugs, you will need to enroll in Medicare Part D to have prescription drug coverage.

Here is the list of the major benefits of Medicare Supplement Plans:

- There is no network for Medicare Supplement. As in Original Medicare, you may visit any doctor or hospital as long as your doctor accepts Medicare (primary coverage). The doctor must accept a Medigap policy (secondary coverage).

- All Medicare Supplement plans (Medigap plans) are guaranteed renewable, even if you have health problems. Guaranteed renewable is when the insurance company cannot cancel your policy as long as you pay the premium.

- You don’t have to file any claims with a Medicare Supplement plan. The claim processing is completed using a prompt and very efficient Medicare crossover system.

- Medicare Supplement provides some extra benefits that are not a part of Original Medicare, such as foreign travel emergency. Several companies offer additional benefits, such as pharmacy savings, vision discount, access to fitness facilities (such as Silver Sneakers), nurse health line, etc.

Standardized Medicare Supplement Plans

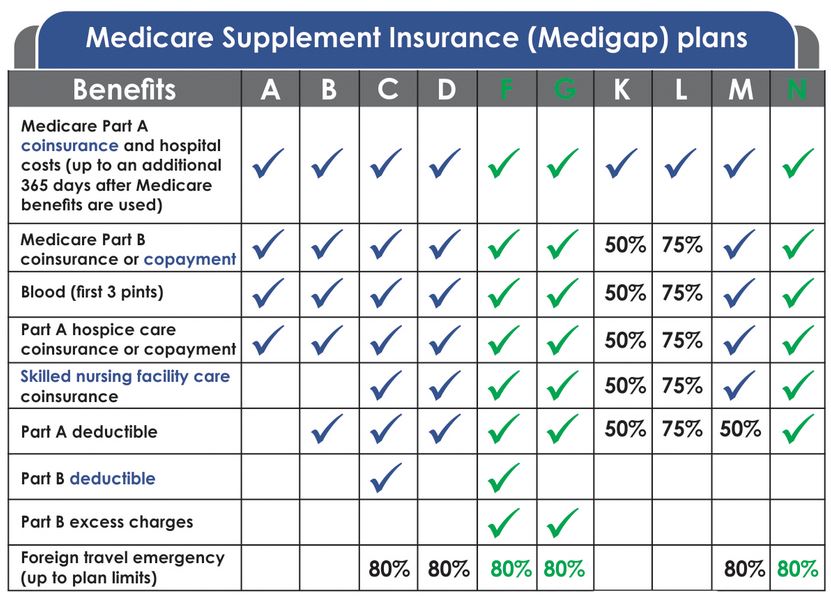

There are 10 Standardized Medicare Supplement Plans. Each plan has a designated letter (e.g., Plan A, Plan B) and a specific set of basic and additional benefits. The Medicare terminology may be confusing, but there is no connection between Medicare Medigap Plans, such as Plan A, and Original Medicare Parts, such as Part A.

Medicare Supplement or Medigap plans are standardized, meaning that any plan bought from one insurance company is identical to the same plan purchased from any other insurance company. The primary difference is the price, which may be pretty substantial. To receive Liberty Medicare quotes, please fill out our Medicare Supplement Quote or give us a call at 877-657-7477.

Understanding Medigap Plans

Medicare Supplement Plan A provides the core benefits. All other Medicare Supplement plans (Plan B, Plan C, etc.) share the common core with Plan A and also offer extra benefits.

Insurance companies that sell Medigap policies are not required to offer every Medigap policy; however, at a minimum, they must provide the basic benefits, which include Medicare Supplement Plan A.

If they do offer any other Medicare Supplement Insurance plan, they must also provide Medicare Supplement Plan D, or Medicare Supplement Plan G. There are also SELECT plans where you must use special hospitals and, in some cases, doctors. They are generally less expensive than the regular plans.

Here is the partial list of the various Medigap plans. It includes the basic plan (Plan A) and other plans used most often:

Medicare Supplement Plan A

Medicare Supplement Plan C

Medicare Supplement Plan D

Medicare Supplement Plan F

Medicare Supplement Plan G

Medicare Supplement Plan N

Do you need help choosing the right plan for you? Find an easy side-by-side comparison in How to Compare Medicare Supplement Plans, or give us a call for assistance at 877-657-7477.

Do I need a Medicare Supplement (Medigap) Policy?

Enrolling in a Medicare Supplement insurance policy gives you peace of mind from the financial exposure of Original Medicare out-of-pocket costs which may be significant!

Note: If you have other coverage, such as an employer group health insurance, you may not need Medigap insurance. Contact Liberty Medicare for any help determining any coverage overlap.

Medicare Supplement Eligibility

You are eligible for a Medicare Supplement insurance plan if:

- You enrolled in Medicare Part A and Part B

- You don’t have any of the following types of health coverage: Medicare Advantage Plan or Medicaid. If you do have one of these health policies, insurance companies generally are not allowed to sell you a Medigap policy.

Medicare Supplement Insurance in Depth

What are the Medicare Supplement Changes since 2020?

How do you compare Medicare Supplement Plans – 2026?

How to Choose a Medicare Supplement Plan and Vendor

Changing Medicare Supplement Plans and the Medicare Supplement Open Enrollment Period

Medicare Supplement Premiums and Rating Methods

Common Medicare Medigap Misconceptions

Medicare Supplement Claims Processing/Claims Decisions

How essential is the Medicare Supplement Insurance Company Rating?

Special Considerations

Medicare Supplement Plans for Disabled Under 65

Medigap State Specific Rules: Plans by State

Frequently Asked Questions

- Do Medicare Supplement (Medigap) plans cover all expenses that Medicare does not cover?

- Medicare Supplement covers only expenses that are entitled to Medicare coverage but not covered entirely by it. The degree of coverage depends on the selected Medigap plan.

- Does any doctor accept the Medigap plan?

- YES, as long as your doctor accepts Medicare.

- Does Medicare Supplement cover a prescription drug plan?

- NO, it does not. You need to buy Medicare Part D (Prescription Drug Plan) separately.

- How do Medicare Supplement benefits depend on Medigap vendors?

- The benefits of Medigap plans are not dependent on vendors. All Medicare Supplement plans are standardized; that is, any plan purchased from one company is identical to the same plan purchased from any other company. The premium, however, may vary from vendor to vendor.

- Can I enroll in a Medicare Supplement Plan without Medicare Part B?

- NO, you should have Medicare Part B to enroll in a Medigap Plan

- I am enrolled in a Medicare Advantage Plan. May I enroll in a Medicare Supplement Plan?

- NO, you are not allowed to have a Medigap plan and a Medicare Advantage plan at the same time.

- Do all states have Medical Underwriting?

- Most of the states do, but some states don’t. For example, New York.

- Am I allowed to get Medigap if I am under 65?

- It depends on the state. Some states allowed people under 65 with Medicare to enroll in a Medigap plan; some don’t

- What is the Medigap free-look period?

- You have 30 days to decide if you want to keep the new Medigap policy. This is referred to as your “free look period.” The 30-day free look period starts when you get your new Medigap policy. You’ll need to pay both premiums for one month. Don’t cancel your first Medigap policy until you’ve decided to keep the second Medigap policy. On the application for the new Medigap policy, you’ll need to confirm that you’ll cancel your current policy.

US Government Sources

- What’s Medicare Supplement Insurance (Medigap)?

- Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare

Let Liberty Medicare Help you Choose

Liberty Medicare is here to help you in all stages of comparing, selecting and enrolling in the best and most suitable Medicare Supplement Plan for you.

All our services are absolutely free to you. We’ll help you:

- Find all plans available to you and compare their benefits

- Determine your eligibility (particularly if medical underwriting is required)

- Find the least expensive Medicare Medigap plan for your needs

- Understand your options when switching plans

Liberty Medicare represents many well-known Medicare Supplement providers in Delaware, Florida, Maryland, New Jersey, New York, Ohio, Pennsylvania, and Virginia. Learn more about all the benefits of working with Liberty Medicare.

If you are looking for Medicare Medigap coverage, let us help you. To view real quotes from Medigap plan providers, please fill out our Medicare Supplement Quote form or give us a call at 877-657-7477.