What are Medicare Advantage plans (Part C plans)?

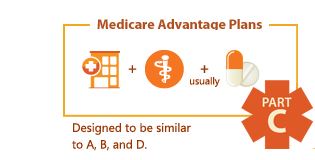

UPDATED Nov. 16, 2025. Instead of staying with Original Medicare (Part A and Part B), you may decide to join a Medicare Advantage Plan that provides an “all-in-one” alternative to Original Medicare, bundling together Part A, Part B, and usually the Medicare Prescription Drug Plan (Part D).

Liberty Medicare Library – Medicare Advantage Plans

Medicare Advantage plans are offered by private insurance companies approved by Medicare. Part C Plans are available in all fifty states. They are not Fee-for-Service plans, such as Original Medicare. Instead, Medicare pays a fixed amount every month to insurance companies for the enrolled members regardless of whether or not members use the services.

Article Contents

Medicare Advantage Plan Benefits

Rules for Medicare Advantage Services

Who is eligible for Medicare Advantage Plans?

How much do the Plan C Plans Cost?

Medicare Advantage Plan Benefits

Medicare Advantage Plans cover all services that Original Medicare covers (Part A and Part B), except hospice care. Original Medicare covers hospice care even if you are in the Medicare Advantage plan.

Although Medicare Advantage plans are supposed to cover everything that Original Medicare covers, there is no obligation to include every benefit in the same way.

If you are enrolled in a Medicare Advantage plan, Medicare services are NOT paid for by Original Medicare.

Medicare Advantage plans are obliged to enroll anyone who is eligible. The same Part C benefits are offered to all members, regardless of age or health status. Consequently, pre-existing health conditions cannot be taken into account, enrollment cannot be denied, and the premium cannot be increased due to health conditions.

There are multiple types of Medicare Advantage Plans available:

- Health Maintenance Organization plans (HMO)

- Prefer Provider Organization plans (PPO)

- Private Fee-for-Service plans (PFFS)

- Medical Savings Accounts plans (MSA)

- Special Needs plans (SNP)

For details, see Types of Medicare Advantage Plans: How are they Compared?

All Medicare Advantage Plans offer a maximum out-of-pocket yearly limit.

Extra Coverage Benefits

Part C plans benefits often include extra coverage, such as:

- Vision

- Hearing

- Dental

- Health and wellness programs

- Gym

- Over-the-Counter Pharmacy Allowance (OTC)

- FLEX Cards

Medicare Advantage plans can come as Medical only (MA) or may include Prescription Drug Coverage (MAPD).

Medicare Advantage vendors are allowed to expand the scope of their coverage and provide several types of non-health-related benefits, such as:

- Adult day care services

- In-home support services

- Home-based palliative care

- Support for caregivers of enrollees (respite care)

- Medically-approved non-opioid pain management

- Stand-alone memory fitness benefit

- Transportation for non-emergency medical services

- Home and bathroom safety devices and modifications

Rules for Medicare Advantage Services

A Medicare Advantage plan can charge different out-of-pocket costs.

Medicare Advantage plans have different rules for receiving services. For example, whether you need a referral to see a specialist, or if you have to engage with doctors, facilities, or suppliers that belong to the plan. Medical emergencies are an exception because no referrals are necessary, and services are readily available throughout the U.S.

The rules can change each year.

You are still a part of the Medicare system. If your Medicare Advantage insurance company fails, you are guaranteed the acceptance back into Original Medicare.

Who is eligible for Medicare Advantage Plans?

You are eligible for a Medicare Advantage plan if:

How Much do the Part C Plans Cost?

Each Part C plan typically charges a monthly premium in addition to the Part B premium (although some plans actually pay the Part B premium). There are additional Medicare Advantage costs for Prescription Drug Coverage (if applicable) and for extra coverage (if applicable). The total cost may be higher or lower than what you would pay under Original Medicare.

Each Part C plan can charge different out-of-pocket expenses. You usually pay copayments for each service. The plan may charge you a yearly deductible or any additional deductibles.

Medicare Advantage In Depth

Medicare Advantage Enrollment Periods

Initial Coverage Election Period (ICEP) and delayed Part B enrollment

How to Compare Original Medicare with Medicare Advantage

How to Choose Medicare Advantage Plan – Questions to Ask

Medicare Advantage Plans for people with Medicare and Medicaid (Dual-eligible)

Frequently Asked Questions

- Do I lose Medicare if I join a Medicare Advantage Plan?

- NO, if you join a Medicare Advantage Plan, you still have Medicare.

- Does Medicare Advantage cover everything that Original Medicare covers?

- Medicare Advantage provides all of your Part A and Part B benefits, but there is no obligation to include every Original Medicare benefit in the same way.

- Am I limited in the choice of doctors and hospitals?

- Yes, you are limited to the plan’s network. If you have a PPO plan, you may visit doctors or hospitals outside of the network, but with higher out-of-pocket expenses.

- Are Prescription Drug plans included in Medicare Advantage?

- Most Medicare Advantage plans include Prescription Drug Coverage (Part D). Some plans do not offer drug coverage (such as Medical Savings Account plans) or allow you a choice in drug plan selection (such as PFFS plans)

- When can I change the Medicare Advantage plan?

- Only at predefined Enrollment periods, such as the Medicare Open Enrollment Period, Medicare Advantage Open Enrollment Period (OEP), and Special Enrollment Period (SEP). Read more in Medicare Advantage Enrollment: When can I enroll?

- Should I contact the old vendor to disenroll from my old plan?

- No, you’ll be disenrolled automatically from the old plan when your new coverage begins

- What will happen if I enroll in a Stand-alone Prescription Drug plan having a Medicare Advantage plan that includes a Prescription Drug plan (MAPD)

- You’ll be disenrolled from the MAPD plan

US Government Sources

Let Liberty Medicare Help You Choose

Liberty Medicare is here to help you every step of the way while you select and enroll in the best and most suitable Medicare Advantage Insurance Plan for you.

All of our services are entirely free to you. We’ll help you compare the key attributes of the Medicare Advantage Plans within your area including:

- Standard Benefits

- Associated Cost

- Doctor Access and Network Limitations

- Extra Benefits

- Prescription Drug Coverage

- Quality of Plan

Liberty Medicare represents many well-known Medicare Advantage providers in Delaware, Florida, Maryland, New Jersey, New York, Ohio, Pennsylvania, and Virginia. Learn more about all the benefits of working with Liberty Medicare.

If you are looking for Medicare Advantage, please let us help. To see accurate quotes from Medicare Advantage providers, we invite you to fill out our Medicare Advantage Quote form. You also may give us a call at 877-657-7477, and you will be connected to a licensed agent/broker.