5 Reasons to Choose Medicare Supplement Plan N (Medigap Plan N)

UPDATED Nov. 17, 2025. Medicare Supplement Plan N, also known as Medigap Plan N, was introduced in June of 2010. To lower monthly premium costs, Plan N uses copays which include: up to $20 for a doctor’s visit, and $50 for emergency visits. The result is an affordable and top-rated plan with a monthly premium 35%-40% lower than the all-inclusive Medigap Plan F and 20%-25% lower than Medigap Plan G.

Get familiar with Medicare Supplement – Liberty Medicare Library

Like all Medigap plans, the Medicare Supplement Plan N is standardized. Its benefits are the same for all insurance companies offering the plan. Premiums, however, can vary significantly from one company to the next. Most Medicare Supplement insurance companies offer Medicare Supplement Plan N. Here, we’ll discuss the main reasons to choose Medigap Plan N in 2026.

Article Contents

Five Reasons to choose Medigap Plan N in 2026

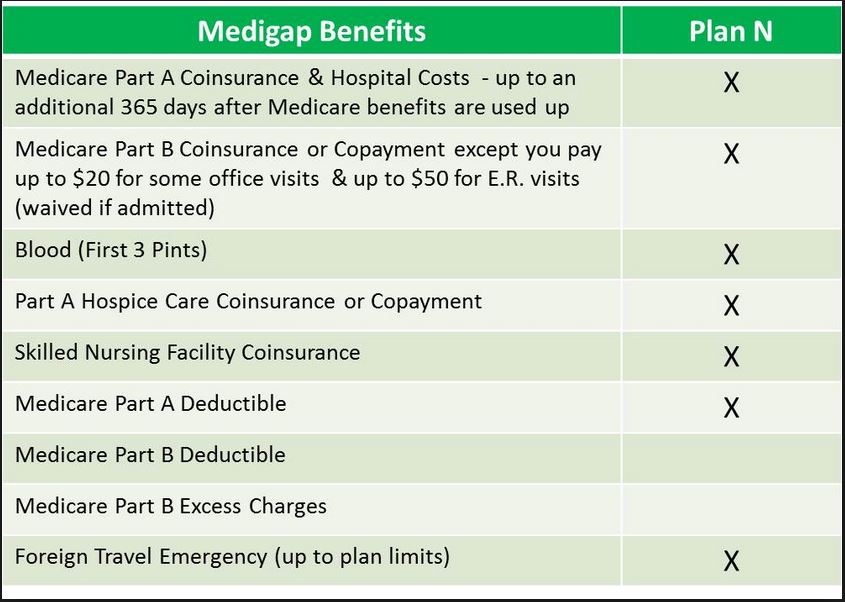

Medicare Supplement Plan N benefits include:

- Medicare Part A coinsurance and hospital costs up to an extra 365 days after Medicare benefits end.

- Medicare Part B coinsurance (usually about 20% of outpatient expenses) or copayment (hospital outpatient services). Copayments are required: up to $20 for a doctor’s office visit and $50 for an emergency visit.

- Blood Coverage: The first 3 pints of blood per year.

- Medicare Part A Hospice Care coinsurance/copayment.

- Skilled Nursing: Medicare Part A coinsurance (20% that Medicare does not disburse for nursing facilities).

- Part A Deductible: $1,736 per benefit period in 2026.

- Foreign Travel Emergency – Emergency Medicare coverage outside of the US.

Medicare Supplement Plan N benefits do NOT include:

- Part B Deductible (in 2026 – $283 per year)

- Medicare Part B Excess Charges (defined as the amount the doctor may charge above the Medicare-approved amount. It cannot be more than15% of what Medicare pays).

Frequently Asked Questions

- How is Medigap Plan N different from Medigap Plans G and F?

- Medigap Plan N is the same as the Medigap Plan G , but in addition, it also includes the following copays: up to $20 for a doctor’s visit, and $50 for emergency visits

- Medigap Plan G is the same as the Medigap Plan F, but it does not cover the Medicare Part B deductible ($283 in 2026).

- Does any doctor accept the Medigap Plan N?

- YES, as long as your doctor accepts Medicare.

- Do Plan N benefits depend on the p vendor?

- The benefits of Medigap plans are NOT dependent on vendors. All Medicare Supplement plans are standardized, i.e., any plan bought from one company is identical to the same plan purchased from any other company. Plan N premium, however, may vary from vendor to vendor.

- Does Medicare Supplement Plan G cover a prescription drug plan?

- NO, it does not. You need to buy Medicare Part D (Prescription Drug Plan) separately.

- What are Medicare Supplement Changes starting 2020?

- Medigap plans that include coverage of the Part B deductible (Plan F, Plan C, and Plan F High-Deductible) are no longer available starting in 2020. However, the current Medigap policyholders and new enrollees up to 2020 are protected.

- What is Medigap Plan N coverage of Foreign Emergency?

- Medicare Supplement Plan N pays 80% of the billed charges for medically necessary emergency care outside the U.S. after you meet a $250 deductible per year.

5 Reasons to Choose Medicare Supplement Plan N in 2026

- This plan is excellent for anyone in good health who only visits a doctor occasionally and doesn’t want to be overinsured.

- For those who are now enrolled in Medicare Advantage and would like to return to Original Medicare, it is important to note that because Medigap plans don’t have network restrictions and much lower out-of-pocket expenses, Medigap Plan N provides a cost-effective alternative to Medicare Advantage.

- It provides a smoother transition to new Medicare members familiar with the copay concept.

- Ultimately, for people who are healthy or on a fixed income, Medicare Supplement Plan N premium savings may offset benefits presented in more expensive plans, such as Medigap Plan F or Medigap Plan G. Good health is essential: savings in premium payments using Medigap Plan N will not compensate you for the money spent on copayments if you see a doctor frequently (let’s say twice per month).

- Starting in 2020, Medicare Supplement plans no longer offer coverage of the Medicare Part B deductible. Medigap Plan N does NOT provide coverage of the Medicare Part B deductible. Therefore, it is available to new enrollees, and its premium will not change dramatically.

US Government Reading

- How to Compare Medigap Policies?

- Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare

Let Liberty Medicare Help you Choose

It may be a challenging task to select the right plan for you, considering there are ten plans to choose from. Not all Medigap providers carry all of these plans. The premiums for the same type of plan offered by different vendors will vary significantly.

Use the Liberty Medicare expertise to your advantage. Find the Medicare Supplement plan that is best for your financial and health needs. All our services are absolutely free to you. Learn more about all the benefits of working with Liberty Medicare.

We represent many well-known Medicare Supplement providers and help people save money on Medicare in the following states:

Get a free Medicare Supplement Insurance Quote, or call us at 877-657-7477. Our specialists are ready to answer your questions.