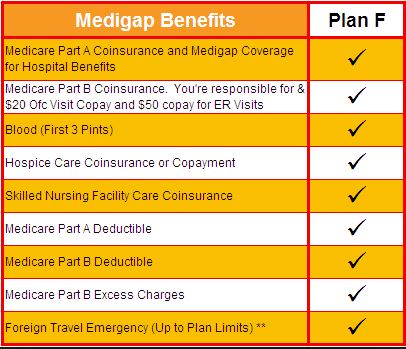

Medicare Supplement Plans in Maryland, also known as Medigap Plans, fill the gaps in Part A and Part B of Original Medicare, such as deductibles, copayments/coinsurances, and excess charges. Without them, your Medicare costs could be very high. Medicare Supplement Plans in Maryland are sold by private insurance companies, and like plans in most other US States, they are standardized. Read more…