UPDATED Mar. 16, 2019. In our post How to Get Low Cost Medicare Part D Plans, we provided several guidelines on Prescription Drug Plans (PDP) savings. The most important of these are: (a) choice of Part D plan should be based on your list of prescriptions, and (b) always use Estimated Annual Drug Costs rather than Monthly Premium as the selection criteria. Here we’ll illustrate these guidelines using a real drug list (we’ve just changed zip code). The mechanics of “How to Compare Prescription Plans using Medicare Part D Plan Finder” will be made very transparent. Read more…

Liberty Medicare Blog

Changes in Medicare home care for Medicare skilled nursing care

There are substantial changes in Medicare home care coverage for Medicare skilled nursing care and rehabilitation therapy for people with chronic conditions and disabilities. The recent settlement (Jimmo vs. Sebelius) removed the “improvement standard” from Medicare requiring an improvement of the patient’s medical condition. Instead, the guidelines have been changed to allow Medicare to pay for services to “maintain the patient’s current condition or prevent or slow further deterioration”, rather than for services meeting the improvement standard.

Why changes in Medicare skilled nursing care are important for home care?

The change is quite significant. The previously used “improvement standard” left out many chronically ill elderly patients hoping just to maintain, rather than to improve, their condition. Read more…

How to avoid costly Medicare mistakes? Medicare Checklist.

UPDATE Jan. 14, 2019. Medicare is not a complicated subject as long as you are familiar with Medicare checklist. These are not strict rules like ‘Who is eligible for Medicare?’ or ‘How do I apply for Medicare?’ but rather practical, common sense tips that can help you to avoid errors and save a substantial amount of money. Therefore, getting as much knowledge as possible about the Medicare checklist is quite essential. Some of them are applicable only when you are turning 65 (or get Medicare because of a disability). Others are available, once you are on Medicare. In any case, here is our Medicare checklist. It will help you to avoid costly Medicare mistakes.

Medicare Checklist

Medicare Checklist – Turning 65

Medicare Checklist – After Medicare Enrollment

Medicare Checklist – Turning 65

Do I need Medicare Drug Coverage?

Do I need to enroll in Medigap plan?

Do I need Medicare Part B?

It depends on whether

- you can afford it

- you or your spouse are currently working and covered by an employer group plan

- you will be ready to enroll in Medigap within six months after getting Part B

How to Get Low Cost Medicare Part D Plans

Updated Dec. 23, 2018. According to a study published in the National Bureau of Economic Research, wrong choices in Medicare Part D seem to be prevalent. Fewer than 10% of individuals are enrolled in the most cost-effective plan. Therefore, the question “How to Get Low Cost Medicare Part D Plans” is very genuine. It may save you thousands of dollars, which quite often much higher savings than those from shopping for MAPD or Medigap plans.

The right Medicare Part D choice is not easy because it is a “moving target.” Patient conditions change, new generic drugs appear on the market all the time, and so forth. Individuals usually change their PDP plan for the next year during the Medicare Open Enrollment Period. Read more…

How does Medicare Cover Shingles Vaccine and Other Vaccinations?

One of our clients recently called us about her confusion with Medicare coverage of the shingles vaccine. Having both Original Medicare and Medigap Plan F, she expected to be fully covered. To her surprise, her cost was about $200. The post below (about Medicare coverage of vaccines in general and the shingles vaccine in particular) attempts to clarify the confusion.

Vaccines covered by Medicare Part B

Medicare Part B covers the three routine immunizations shown in the table below. Read more…

Medicare and Other Health Insurance: Who Pays First?

UPDATED on Nov. 17, 2025. If you have Medicare in addition to another health insurance plan (such as an employer group health plan), there are rules that decide who pays first. The primary payer pays the bill first, up to the limits of its coverage. The secondary payer pays any costs left uncovered by the primary payer (again, up to the limits of its coverage).

The table below is taken from the government publication Medicare and Other Health Benefits: Your Guide to Who Pays First. It provides a detailed explanation of the matter. Read more…

Welcome to Liberty Medicare Website

We are excited to share our new Liberty Medicare website and blog with you. We have designed Liberty Medicare website to be a one-stop source of information for your Medicare and Individual Health questions and needs. Now it is up to you, our visitors, to decide whether or not we have succeeded in our endeavor.

Who are we?

Liberty Medicare is NOT a new health insurance agency. We started our operation several years ago under the name of Medicare-PA-NJ-DE. Medicare-PA-NJ-DE specialized in Medicare insurance for Pennsylvania, New Jersey, and Delaware and provided a full range of Medicare insurance options (Medicare Supplement, Medicare Advantage, and Medicare Prescription Drug Plan) for the above states.

Later, we extended our operation to five more states and added support for Individual Health plans and other plans such as Dental and Supplemental Insurance. We even provided Visitors Health Insurance for people visiting the US. Obviously, the old name was not adequate anymore. The new name we chose, Liberty Medicare, does not limit our operations to any particular state. Instead, it highlights our commitment to Medicare and enables us to be active with other health insurance plans as well. Liberty Medicare website reflects our commitment in maintainig several lines of businesses in multiple states Read more…

Medicare MSA Plans – Lasso Healthcare MSA – 2019

UPDATED Feb. 2, 2019. Medicare MSA Plans (Medical Savings Account Plans) is one of the Medicare Advantage (MA) Plan types. However, it is quite different from the traditional HMO and PPO MA Plans. The major features of MSA plans are described below. Lasso Healthcare MSA is used for illustration.

Medicare Summary Notice (MSN) – How Medicare Claims Are Reported

Medicare Claims are reported using Medicare Summary Notices (MSNs). If you are in Original Medicare, then you should receive a Medicare Summary Notice on a regular basis – every three months. It is NOT a BILL. It is a list of your claims for health care services provided by Original Medicare (Part A and Part B). It does not reflect any services rendered through Medicare Advantage, Part D or Medigap Plan.

In your MSN, Part A services are listed separately from Part B services.

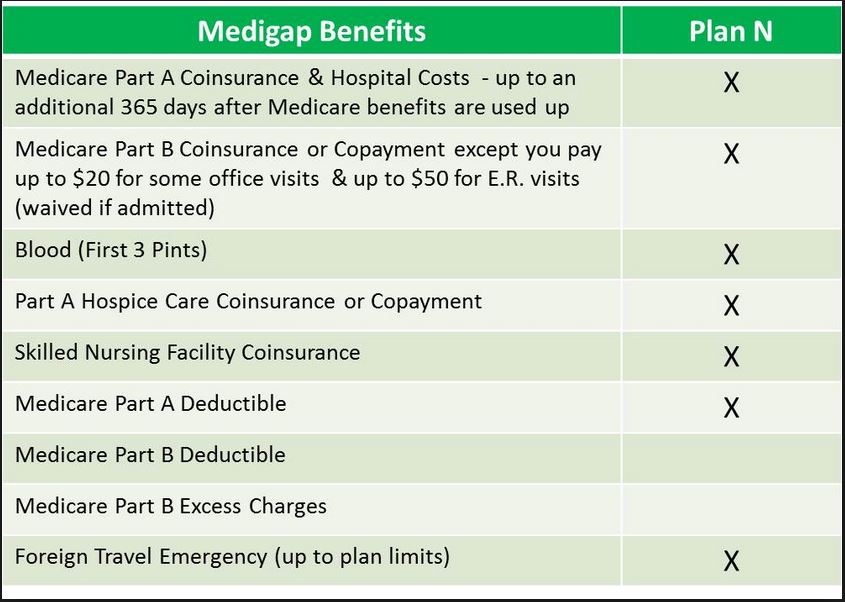

Lessons Learned from the Medigap Plan N Story

On June 1, 2010, all Medigap plans were substantially changed. Some were eliminated, some were added, and most of the existing plans were modified. Two new Medicare Supplement Plans (M and N) were added, and one of the two plans – Medicare Supplement Plan N – was very popular. Recent developments, however, may change this assessment. Here are lessons learned from the Medigap Plan N story.

Medigap Plan N Basics

Medicare Supplement Plan N provides cost-sharing features with lower premiums than standard plans, such as Medigap plans F and G. Its cost is about 45% of Medicare Supplement Plan F’s cost. Medigap Plan N is as good as the Medigap Plan F, except:

- It does not pay the Part B Annual Deductible

- It does not pay Part B Excess Charges

- It pays 100% of the Part B coinsurance except for up to $20 copayment for office visits and up to $50 copayments for emergency department visits

In other words, the most critical Medigap benefits (Part A coinsurance and deductible and Part B coinsurance) are fully covered with $20/$50 copayments as described above. These copayments result in substantial Medicare Supplement Plan N premium savings compared with other Medicare Supplement plans. Read more…